During the National Day holiday, LME nickel fluctuated upward before retreating, with lows around $17,000/mt and highs reaching approximately $18,200/mt. According to SMM analysis, the rise in nickel prices was mainly driven by macro factors. However, the prices fell back shortly after due to insufficient fundamental drivers.

Macro Boost Factors

Domestically, the Chinese government announced a series of favorable policies, including reducing the reserve requirement ratio, lowering the mortgage rate on existing home loans, and unifying the minimum down payment ratio for mortgages. These policies boosted market confidence and stimulated consumption expectations.

Internationally, the U.S. added 254,000 non-farm jobs in September, far exceeding the market's general expectation of 150,000 and the previous figure of 142,000. The positive performance of domestic and international policies and macro data effectively boosted market sentiment, driving up the prices of non-ferrous metals and strengthening LME nickel prices.

Fundamental Analysis

From the stainless steel and ternary materials sides, weak consumption continued to suppress the performance of various segments in the nickel industry chain.

Ternary Materials Side

Demand for ternary cathode precursors was brought forward to September, and with the domestic holiday, the operating rate remained relatively low and pessimistic. In terms of nickel sulphate, due to high raw material prices and relatively tight supply, the operating rate decreased YoY. However, due to partial recovery of profits at nickel salt smelters, the operating rate increased MoM. Therefore, the supply-demand structure of nickel sulphate became relatively relaxed compared to earlier periods.

Stainless Steel Side

Overall consumption was weak throughout the year. Entering Q4, the demand for nickel from stainless steel mills is unlikely to increase, and some mills may engage in destocking. Therefore, SMM held a relatively pessimistic view on the driving factors for nickel consumption in the stainless steel sector. From the supply side of stainless steel raw materials, tight supply of high-grade nickel ore led to a continuous rise in NPI raw material prices, resulting in reduced production from existing NPI projects. However, new projects coming online in H2 2024 will maintain an overall increase in NPI production. From the NPI supply-demand perspective, the tightness in H2 eased, beginning to show a surplus. The surplus is expected to widen further.

Raw Material Side Analysis

The raw material side is divided into nickel ore and intermediate products.

Nickel Ore Side

Approaching year-end, the current RKAB approval quota reached 248 million wmt, while SMM estimates that the annual demand for Indonesian nickel ore in 2024 will be around 240-280 million wmt. Overall, nickel ore supply remained relatively tight but eased compared to earlier periods. Prices of low-grade nickel ore and Philippine nickel ore softened due to insufficient downstream purchasing motivation. However, high-grade nickel ore prices remained relatively firm due to tight supply. Therefore, nickel ore prices remain a core focus and a point of speculation in the market, requiring close attention to related policies released by the Indonesian government.

Intermediate Products Side

In terms of hydrometallurgy intermediate products, the supply of low-grade nickel ore was relatively sufficient, with new hydrometallurgy intermediate projects in Indonesia coming online smoothly, and production from previously reduced projects gradually recovering, maintaining an increase in supply. On the demand side, the production of nickel sulphate rebounded, and electro-deposited nickel showed stable growth, leading to increased demand for MHP. Therefore, the tight balance expectation for MHP remains unchanged, but downstream profit compression leads to low acceptance of high-priced raw materials, which may cause slight easing in MHP prices.

In terms of pyrometallurgy intermediate products, high-grade nickel matte projects will reach a peak production period in 2024. Thus, the supply increase of high-grade nickel matte is significant, but continuous profit compression led to reduced production from existing projects. Overall, with many new projects, the total supply of high-grade nickel matte remains relatively stable. However, upstream producers maintain firm selling prices, and downstream purchasing motivation is insufficient, slightly loosening the supply-demand structure.

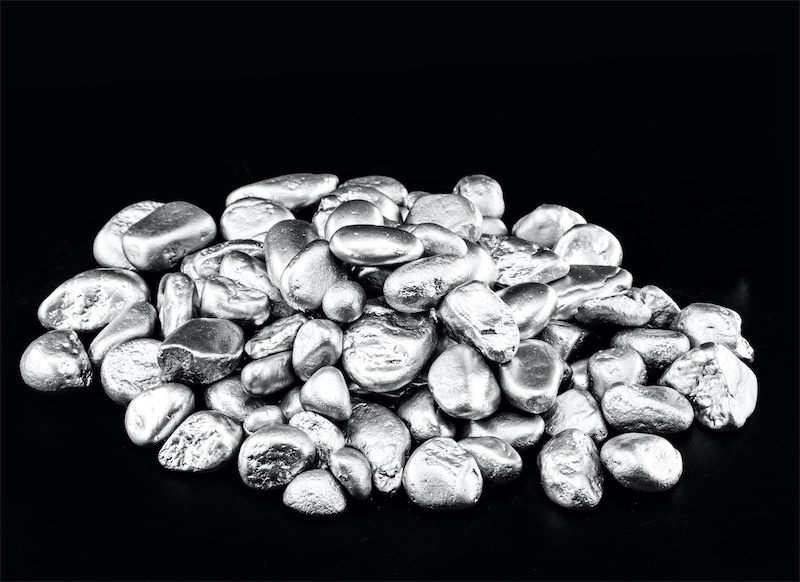

Refined Nickel Market

Electro-deposited nickel producers continued to increase production while downstream consumption was limited, with the trend of inventory accumulation unchanged.

Core Judgment on Nickel Prices

Currently, the theoretical lower boundary of nickel prices needs to focus on the cost situation of producing refined nickel by integrated intermediate products. Based on current nickel ore prices, the capacity for producing refined nickel from externally purchased raw materials is small and significantly loss-making. The production cost of refined nickel is around $16,000-$16,500, which is close to the break-even point. The cost of producing refined nickel from integrated MHP is about $14,000, while from integrated high-grade nickel matte is about $16,000. Therefore, with some production lines already experiencing losses, the downside space for refined nickel prices is relatively limited.

In the future, nickel ore prices will significantly impact the cost of producing refined nickel from intermediate products, so attention must be paid to nickel ore-related policies and price trends.

In summary, macro-level benefits temporarily boosted nickel prices, but insufficient fundamental factors limited their upward space. The future market needs to closely monitor multiple factors such as raw material supply, policy releases, and upstream and downstream demand.

![[SMM Stainless Steel Flash] Fu'an Aims for $246B in Stainless Steel Output by 2026, Advances 600,000-Ton CR Project](https://imgqn.smm.cn/usercenter/KFwsY20251217171734.jpg)

![[SMM Stainless Steel Flash] Fujian Tsingshan's Stainless Steel Deep Processing Project Receives Construction Permit](https://imgqn.smm.cn/usercenter/Btmsv20251217171733.jpg)

![[SMM Stainless Steel Flash] EU Fastener Distributors Warn CBAM Acts as Penalty Tariff; Import Costs Surge Up to 50%](https://imgqn.smm.cn/usercenter/qLeLR20251217171733.jpg)